Commercial Valuation

Commercial

Property Valuation

Melbourne

FVG Property is considered to be one of the best providers of commercial property valuation in Melbourne. Our experience in the industry and team of commercial property valuers has earned us our reputation in the Melbourne market place. Seek our expert advice to get the most out of your prospective investment when you are searching for a suitable commercial property at a website such as Commercial Property Guide.

To get in touch with our commercial selling agents, visit our office or give us a call.

Our team of commercial valuers are experienced individuals with over 20 years in the real estate market. They are members and qualified with the: Australian Property Institute, The Real Estate Institute of Victoria, Royal Institute of Chartered Surveyors

FVG Property have also assisted major public listed entities, private investors, occupiers, developers and other parties with Commercial Valuations all for a variety of reasons.

Our Commercial Valuation Reports Include

1. Executive Summary:

Terms of Reference, Certification, Synopsis, Definition of Market Value, Risk Assessment, Key Assumptions, Verifiable Assumptions and Recommendations

2. Valuation:

Date of Inspection, Date of Valuation, Valuation Criteria

3. Site Details:

Location

4. Legal Description:

Title Details, Registered Proprietor, Easements and Encumbrances, Identification

5. Land Details:

Dimensions and Area, Topography and Services, Environmental Risks

6. Town Planning:

Planning, Council Area and Zoning, Existing Use, Heritage Listing, Statutory Valuation Assessments

7. Improvements:

General Description, Construction, Accommodation, Building area, Features, Ancillary Improvements, Car accommodation, State of Repair and Condition, Annual Essential Safety Measurements Report, Occupational Health and Safety

8. Valuation Considerations:

Local Property Comments, Tenancy Details, Domestic Economic Conditions (Reserve Bank of Australia), Ownership History, Salability, Goods and Services Tax (GST)

9. Valuation Analysis:

Comparable Sales Evidence, Comparable Rental Evidence

10. Asset Performance Risk:

Market, Asset, Cash flow, Management, Ownership, Legal, Environmental, Obsolescence

11. SWOT Analysis:

Strengths, Weaknesses, Opportunities, Threats

12. Valuation Rationale/Approach:

Direct Comparison Approach – Primary Method, Income Capitalization Approach

13. Insurance Assessment:

Assessed Insurance Value

14. Qualifications

15. Annexures:

Location Map, Property Photographs, Monetary Policy

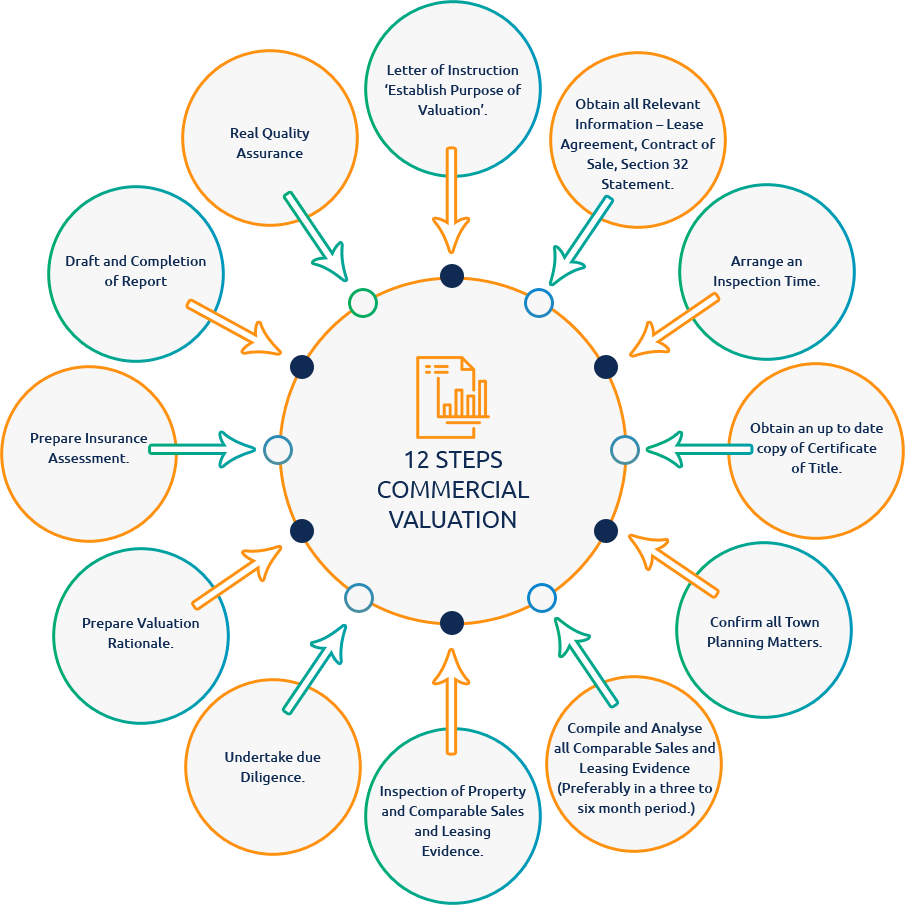

The More Salient Steps That a FVG Property Will Undertake a Commercial Valuation is as Follows:

Contact Us

Let’s Talk 03 9690 1112

Ask us about our services or tell us a bit about yourself and your business. We’re all ears.

EMAIL: fvg@fvg.com.au

ADDRESS: Suite 110181 St Kilda Road, St Kilda, Vic 3182

Send Us Your Enquiry

Suite 110181 St Kilda Road, St Kilda, Vic 3182